The Best Bookkeeping for Small Businesses

Bookkeeping done for you with easy-to-understand reporting. Take the tedious back-office work off your plate so you can focus on your business.

Get started with a free live virtual bookkeeping consultation.

This is a Paragraph Font

400% ROI

From small business

services on average

25 Hours

Saved during tax

preparation

1 Million+

Consultations

delivered

Certified experts help you maintain your books

Our certified US-based accountants have more than 17 years of experience on average. Partner with a bookkeeper who has experience in your industry and state. You can rely on MirchCPA LLC's dedicated bookkeepers to accurately categorize transactions and reconcile your accounts.

Freedom to focus on your business

Let us handle your everyday small business bookkeeping tasks so you can focus on what you do best – running your business.

Accurate, detailed books done for you

Accurately categorized transactions and reconciled accounts. Make business decisions based on up-to-the-minute information.

Game-changing features

Keep things running smoothly: Automatically connect bank accounts, send invoices, upload receipts and track mileage.

“The bookkeeping service I have is excellent. I have used this service for 3+ years, which has made business financial management much easier.”

KG

April 2023, Trustpilot

Actual customer testimonial. Photo is illustrative only.

Save yourself the hassle. Let us handle your bookkeeping.

The simple way to do

your books:

Schedule your live digital bookkeeping service consultation.

Find the right combination of services for you.

Explore our portal for online bookkeeping services for small businesses.

Frequently Asked Questions about Bookkeeping

How does MirchCPA LLC make sure my business bookkeeping services and tax forms are accurate and error-free?

MirchCPA LLC's small business bookkeeping clients enjoy our satisfaction guarantee. Our bookkeeping service is designed to provide excellent value to small business clients, ensuring accuracy and reliability. If you feel the forms or any aspect of our professional bookkeeping services doesn’t meet that standard, you can request a refund of the prorated balance within your first 30 days of use.

How long does it take to onboard and start receiving services once I sign up?

Onboarding times will vary depending on the complexity of your financial situation and typically take about a week on average. Once onboarding is complete, your monthly financial statements detailing the previous month's performance are prepared and sent to you on or before the 15th of every month.

What information, logins, and forms does MirchCPA LLC need to start providing business bookkeeping services?

Your expert bookkeeper will need a few items and information to start doing your books and providing business bookkeeping services, including:

1. Prior year financial statements and depreciation schedule

2. Bank and credit card statements

3. Bookkeeping software access

What is the cost of business bookkeeping services with MirchCPA LLC?

The volume of your financial transactions will determine your bookkeeping cost. The small business expert conducting your discovery consultation will disclose bookkeeping pricing details during this discussion, tailoring them to your business needs and budget.

Review our affordable service packages via our pricing page. Both monthly and annual subscription options are available.

Will MirchCPA LLC work with our existing bookkeeping software (QuickBooks, FreshBooks, Wave, etc.)?

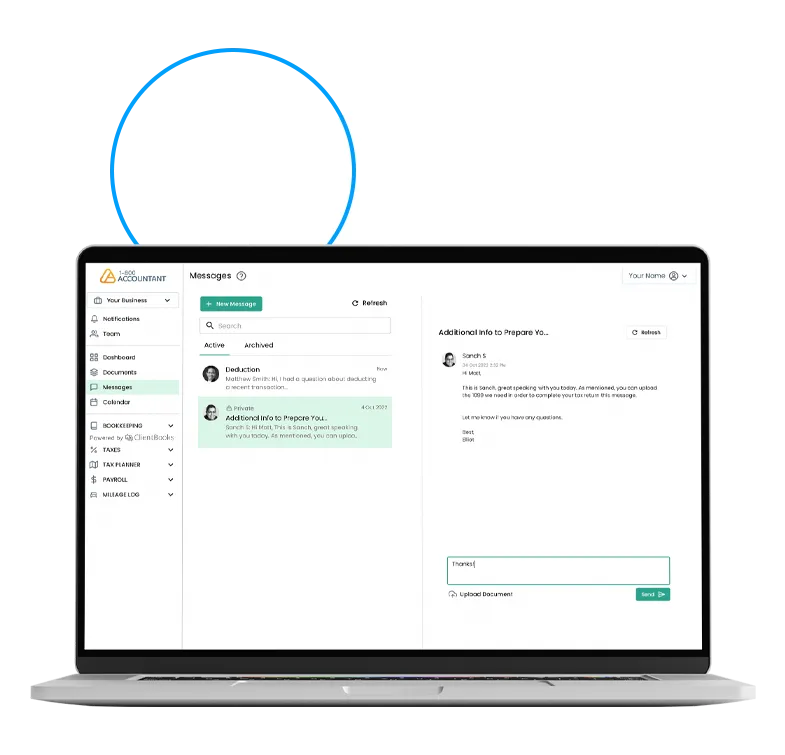

MirchCPA LLC's proprietary bookkeeping platform, ClientBooks, is compatible with leading accounting software, including QuickBooks Online (QBO), FreshBooks, and Wave. Our bookkeepers are fluent in these platforms, ensuring seamless integration and financial data management.

Will we have a dedicated bookkeeper when using MirchCPA LLC’s bookkeeping services for small businesses?

Unlike do-it-yourself (DIY) bookkeeping software and accounting services, MirchCPA LLC provides dedicated bookkeeping and back bookkeeping services done-for-you (DFY). Your dedicated bookkeeper will work closely with you, providing personalized support and ensuring your books are managed accurately and efficiently, giving you the insights you need to make critical, data-backed business decisions.

How will we communicate with our bookkeeper (phone, email, video, etc.), and how often?

Your dedicated bookkeeper will primarily communicate with you through messaging and calls. Messages are sent and received via your MirchCPA LLC Client Portal, typically within 24-72 hours. You can schedule a monthly call to discuss financial statements, ask questions, and address pressing concerns. Additional phone calls with your dedicated bookkeeper can be scheduled as needed.

We operate in multiple states. Is MirchCPA LLC right for our business bookkeeping needs?

MirchCPA LLC, America’s leading virtual accounting firm, offers financial services to small businesses nationwide, serving a diverse range of industries across all 50 states. Whether your business operates in multiple states or you're planning a future expansion, our bookkeeping service supports your ambitions. In addition to bookkeeping, we offer quarterly estimated tax preparation, audit defense, and other essential financial services that maximize your tax savings while ensuring compliance for complex, multi-state operations.

We’re behind on our books. Can MirchCPA LLC help us catch up on our business bookkeeping?

Small businesses rely on MirchCPA LLC's catch-up bookkeeping service to get their books up to date. No matter how far behind you are–even by months or years–our robust catch-up bookkeeping service will catch you up quickly with error-free results. Knowing your books are accurate and up to date provides relief and peace of mind, empowering you to focus on other aspects of your business.

Can MirchCPA LLC also prepare and file our taxes, along with doing our business bookkeeping?

Yes, MirchCPA LLC offers a suite of professional small business accounting and tax services to small business owners and entrepreneurs, ensuring IRS compliance year-round while minimizing their annual tax burden. In addition to DFY business bookkeeping, our services include business tax preparation and filing, tax advisory, and payroll. Like all MirchCPA LLC tax solutions, these services are affordable and tax-deductible.

Can I choose between cash and accrual-based accounting for my business bookkeeping services?

ClientBooks, our proprietary business bookkeeping platform, currently supports accrual basis accounting. This method records transactions based on when a product or a service is exchanged. Revenue transactions are recorded on the date that a customer becomes legally obligated to pay you for providing a product or a service. Expense transactions are recorded when you become legally obligated to pay for a product or service received.

What types of businesses does MirchCPA LLC support with bookkeeping services?

MirchCPA LLC serves the needs of small businesses in all 50 states with bookkeeping and a suite of financial services designed to save more of your time and hard-earned money, so you can focus on what matters: your business. Our services are affordable, tax-deductible, and are designed to scale with your business as it grows, supporting you throughout your career as an owner and entrepreneur.

How often are my business books updated or reconciled?

When you trust your business's complex bookkeeping work with MirchCPA LLC, your designated bookkeeper will reconcile your accounts monthly. We can accommodate unique bookkeeping requirements that would mandate a higher or lower reconciliation frequency for your business.

Can I cancel or change my business bookkeeping plan at any time?

MirchCPA LLC offers a 30-day satisfaction guarantee, providing excellent value to our small business clients. If you feel any aspect of our bookkeeping service or any other service you're using doesn’t meet that standard, you can request a refund of the prorated balance within your first 30 days of use. You can also add additional services from MirchCPA LLC, including tax advisory services and audit defense, throughout your time as a client.

Is my financial data secure when using MirchCPA LLC’s business bookkeeping services?

When using MirchCPA LLC's full-service, tax-deductible bookkeeping solution, rest easy knowing your data is safe and secure. We use the industry standard 128-bit SSL encryption to protect your information. As an added safeguard, our team remains vigilant to emerging threats to help ensure your data is secure.

What tasks are included in MirchCPA LLC’s business bookkeeping services?

Your designated full-service bookkeeper will handle everyday bookkeeping tasks for your small business, ensuring the accurate categorization of transactions and that your accounts are consistently reconciled. Accurate bookkeeping is a tedious and time-consuming task that is best left to experts, particularly if you have complex bookkeeping requirements.

What happens if I miss sending documentation or uploading receipts for bookkeeping?

It is essential to transmit documentation and receipts to your designated bookkeeper promptly to avoid an incorrect or incomplete view of your business's financial situation. While we offer full-service bookkeeping to small business clients, we depend on your active participation to ensure accuracy so that you can make critical business decisions based on up-to-the-minute data.

Do you offer payroll or invoicing as part of your business bookkeeping services?

We offer payroll services for small businesses with one or multiple employees. Invoicing is achieved via our proprietary bookkeeping platform, ClientBooks. Currently, our software requires clients to download the invoice to their device and send it through their email provider. Sending invoices directly from ClientBooks is a feature that will be available in a future version of the platform.

Learn More About Bookkeeping

Bookkeeping Terminology:

35 Common Bookkeeping Terms

I cannot emphasize enough the advantages that effective bookkeeping brings to small business owners. By diligently tracking...

How to Create a Simple Bookkeeping Spreadsheet for

Your Business

Efficiently managing your business finances may seem like a challenging task, but with a well-structured bookkeeping spreadsheet, you can...

Virtual Bookkeeping: How To Find the

Best Online

Bookkeeper

Bookkeeping is something that all businesses will benefit from starting. When it comes to how you do your bookkeeping, you may not know...

Talk to MirchCPA LLC. Say Hello to Better Bookkeeping.

Everything Accounting, All in one Place

Tax and Advisory

We save small businesses more than $12,000 per year on taxes. We guarantee your largest possible refund.

Payroll

Simple integrations, automatic calculations. Running payroll and benefits is easy with experts on your team.

Entity Formation

Entity selection is the key to tax savings. Partner with us to ensure you pick the best one for your situation.

Subscribe to our exclusive newsletter:

for tax tips, insights, and more, curated to help your business grow.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

*Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

*Historical first-party data.

SERVICES

PRICING

COMPANY

RESOURCES

Copyright 2026. MirchCPA LLC. All Rights Reserved.