Small Business

Payroll Services

Get your maximum refund with personal income tax services from the leaders in virtual accounting. Schedule a free consultation to get started.

This is a Paragraph Font

400% ROI

From small business

services on average

25 Hours

Saved during tax

preparation

1 Million+

Consultations

delivered

Fast, affordable payroll

services for small business

State ID registration

We work with your state to obtain important state identification pertaining to unemployment and withholding.

Transparent pricing.

Flat pricing with no hourly rates or hidden fees. No surprises.

Your expert will set you up for success

As a small business owner, we'll help you determine the ideal mix of online payroll and accounting services for your business.

Powerful features give you freedom to focus

Pay your employees in just a few clicks. Spend minutes on payroll each month instead of hours with our online payroll service for small businesses.

We file your payroll taxes automatically

Our accountants submit your small business payroll taxes every time we run payroll for no additional charge.

“My bookkeeper and payroll specialist are awesome. Accurate and professional services every time.”

Kimberly G.

January 2023, Trustpilot

Actual customer testimonial. Photo is illustrative only.

Time-saving strategies

Spend less time running payroll and more time running your day-to-day business.

Talk to an expert anytime

Get advice on creating procedures for payroll processing, tax payments, and reporting.

Experience you can

rely on

100,000 small business served. We have accounting teams in every region and experts in every industry.

Get a free quote.

Schedule a free call.

Schedule your free consultation with a payroll expert.

Discuss your business and how our small business payroll service fits in.

We set it up for you. Pay your team in a few clicks.

Frequently Asked Questions about Payroll

What features does MirchCPA LLC's payroll service offer?

Our robust, full-service payroll solution handles all of your requirements and responsibilities each pay period. Here's how it works: Your payroll expert will collect and address your employees' hours, earnings, deductions, and other data required to calculate net pay. They will then distribute wages to your employees and report and remit associated taxes to relevant governmental authorities.

How does MirchCPA LLC's payroll service help with tax filing and compliance?

Our payroll experts file all quarterly and annual reports federally and with the state and remit all payroll employer taxes due on your behalf.

We maintain your business's compliance with federal and state laws in several ways. Compliance is achieved by ensuring your employees are classified correctly, your payroll is calculated accurately, and it is run on time each pay period. We'll also keep accurate records detailing all hours worked, wages paid, deductions, and withholdings associated with your employees' pay.

What software and services does MirchCPA LLC payroll connect to?

Our payroll experts utilize custom internal payroll software built for businesses that haven't used payroll previously and for businesses that have. Transitioning to our payroll system is seamless, with your team migrating your previous reporting and performing manual adjustments to ensure accuracy. Additional protocols are in place if compatibility or other issues with your previous payroll provider occur.

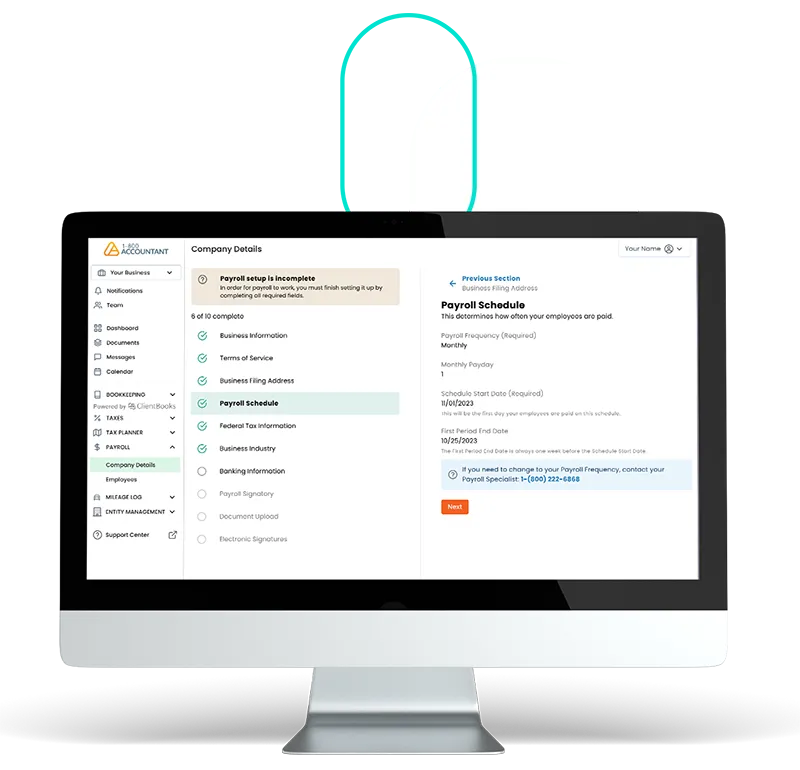

What is the process for onboarding to MirchCPA LLC’s payroll service?

The onboarding process consists of a few steps. First, you will participate in a call with your payroll specialist so they can better understand your business and payroll filing obligations. They may ask for specific information needed for the state payroll registration process. Next, your payroll specialist will obtain your unemployment ID and withholding number, which are required to run payroll. To conclude onboarding, your payroll specialist will notify you when registrations are received so they can complete the process. After onboarding has concluded, we can begin running payroll for your business.

How does MirchCPA LLC’s payroll service simplify payroll for small businesses?

Unlike do-it-yourself payroll offerings, which require your time and attention, our payroll solution is full-service, with your obligations handled for you. Typically, the IRS and state will set a depositary schedule to receive the funds, which your payroll expert will adhere to while handling your registrations, filings, and tax remittances.

Does MirchCPA LLC prepare and file W-2 and 1099 forms?

Yes, our payroll experts prepare and file IRS Form W-2 and IRS Form 1099-MISC on your behalf. Here's how it works: We send your W-2s to the IRS and your state. Depending on its specific requirements, 1099s are sent to the IRS and potentially to your state. We then file these forms electronically, concluding the process.

What states does MirchCPA LLC serve?

We provide financial services to small businesses in established and emerging industries in all 50 states. In addition to payroll, we offer business tax preparation, tax advisory, and other essential financial services that maximize your tax savings.

We serve all localities in each state, some of which can be viewed via our locations hub.

How much does running payroll cost with MirchCPA LLC?

Unlike other payroll services that are do-it-yourself and require your time and participation, our payroll solution is full-service and done for you. There is a one-time $200 setup fee. After setup, our payroll service costs $89/month or $979 annually for your first employee and $39/month or $429 annually per additional employee.

Review our affordable service packages for your business via our pricing page.

Learn More About Small Business Payroll Services

Paying Employees: How to Run Payroll for Your Small Business

If you want your small business to grow, you will need to find employees you can trust to work with you. You can’t carry an expanding...

5 Tips to Make Payroll More Efficient

Operating a small business often involves navigating a critical, yet time-consuming element – payroll, especially if you have employees...

Everything You Need to Know About Payroll Taxes

Payroll is most likely one of the largest expenses you’re responsible for as a business owner. It’s also one of the most important, as...

Talk to MirchCPA LLC. Say hello to easier payroll.

Everything Accounting, All in one Place

Tax and Advisory

We save small businesses more than $12,000 per year on taxes. We guarantee your largest possible refund.

Bookkeeping

Bookkeepers save you time and money. Focus on running your business and let us handle your day-to-day accounting.

Payroll

Entity selection is the key to tax savings. Partner with us to ensure you pick the best one for your situation.

Subscribe to our exclusive newsletter:

for tax tips, insights, and more, curated to help your business grow.

*Based on a $12.2k average 2022 tax refund per client, which is 4x the cost of a full-service package. Source: first-party data.

*Includes average business tax preparation, form completion and submission, record keeping, and other misc admin time. Source.

*Historical first-party data.

SERVICES

PRICING

COMPANY

RESOURCES

Copyright 2026. MirchCPA LLC. All Rights Reserved.